UNITED STATES

|

| | | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

SCHEDULE 14A |

SCHEDULE 14A

|

|

INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION

|

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant x |

|

Filed by a Party other than the Registranto |

|

Check the appropriate box: |

x

ý | | Preliminary Proxy Statement |

o |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | | Definitive Proxy Statement |

o | | Definitive Additional Materials |

o | | Soliciting Material Pursuant to §240.14a-12 |

|

PENNS WOODS BANCORP, INC. |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x

ý | | No fee required. |

o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1)

| (1 | ) | | Title of each class of securities to which transaction applies: |

| | |

| (2 | (2)

) | | Aggregate number of securities to which transaction applies: |

| | |

| (3 | (3)

) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4 | (4)

) | | Proposed maximum aggregate value of transaction: |

| | |

| (5 | (5)

) | | Total fee paid: |

| o | | |

o

| Fee paid previously with preliminary materials. |

o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1)

| (1 | ) | | Amount Previously Paid: |

| | |

| (2 | (2)

) | | Form, Schedule or Registration Statement No.: |

| | (3 | ) | | Filing Party: |

| (3)

| Filing Party:

|

| (4 | ) | |

| (4)

| Date Filed: |

2014 PROXY

2012 PROXY

|

| PENNS

WOODS |

BANCORP, INC. |

PENNS WOODS BANCORP, INC.

300 Market Street

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The Annual Meeting of Shareholders of Penns Woods Bancorp, Inc. (the “Corporation”) will be held at the

HolidayPine Barn Inn,

Williamsport, 1001 Pine

Street, Williamsport,Barn Place, Danville PA

17701,17821, on Wednesday, April

25, 201230, 2014 at 1:00 P.M. Only holders of record at the close of business on March

1, 2012,3, 2014, are entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof.

At the

20122014 Annual Meeting we will:

1.Elect three (3) Class 2

| |

1. | Elect four (4) Class 3 director nominees of the board of directors, to serve for a three-year term that will expire in 2017, and until their successors are elected and qualified (Proposal No. 1); |

| |

2. | Consider a proposal to amend Articles of Incorporation to reduce the supermajority shareholder vote necessary to approve acquisitions of other companies from 66-2/3% of oustanding shares to a majority of shares voted (Proposal No. 2); |

| |

3. | Consider a proposal to adopt the 2014 Penns Woods Bancorp, Inc. Stock Incentive Plan (Proposal No. 3); |

| |

4. | Ratify the appointment of S.R. Snodgrass, A.C., of Wexford, Pennsylvania, Certified Public Accountants as the independent registered public accounting firm for the Corporation for the year ending December 31, 2014 (Proposal No. 4); and |

| |

5. | Transact such other business as may properly come before the Annual Meeting, and any adjournment or postponement thereof. |

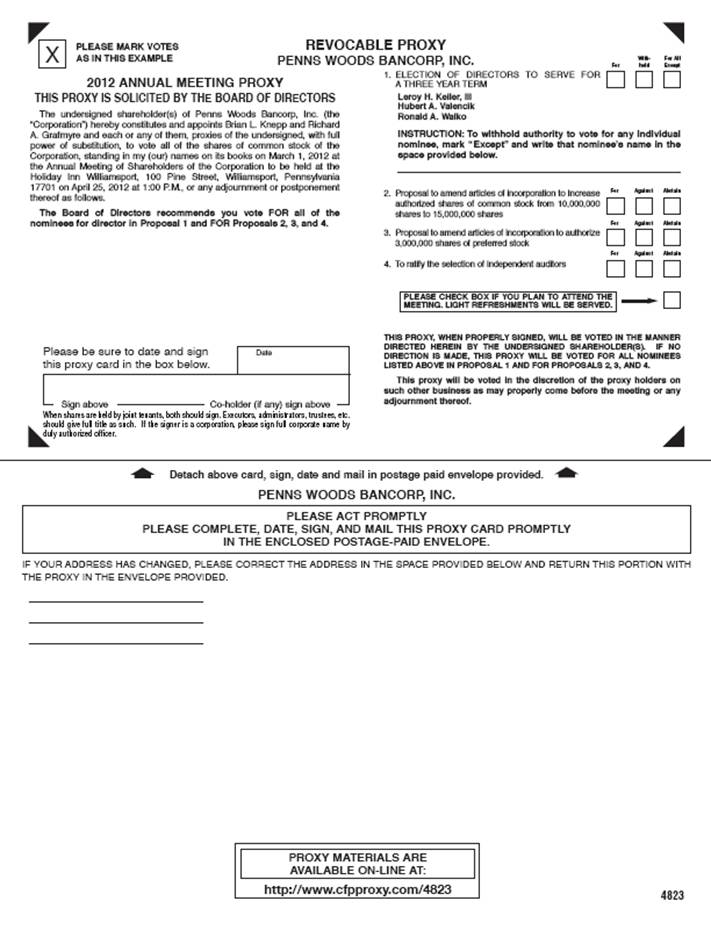

The board of

the Board of Directors, to serve for a three-year term that will expire in 2015, and until their successors are elected and qualified (Proposal No. 1);2.Consider and vote upon an amendment to the Corporation’s articles of incorporation to increase the authorized number of shares of common stock from 10,000,000 to 15,000,000 (Proposal No. 2);

3.Consider and vote upon an amendment to the Corporation’s articles of incorporation to authorize 3,000,000 shares of preferred stock (Proposal No. 3);

4.Ratify the appointment of S.R. Snodgrass, A.C., of Wexford, Pennsylvania, Certified Public Accountants as the independent registered public accounting firm for the Corporation for the year ending December 31, 2012 (Proposal No. 4); and

5.Transact such other business as may properly come before the Annual Meeting, and any adjournment or postponement thereof.

The Board of Directorsdirectors recommends that you vote “FOR” each of the proposals.

You are urged to mark, sign, date, and promptly return your proxy in the enclosed postage-paid envelope so that your shares may be voted in accordance with your wishes and in order that the presence of a quorum may be assured. The prompt return of your proxy, regardless of the number of shares you hold, will aid the Corporation in reducing the expense of additional proxy solicitation.

You may also vote your shares by using the Internet at http://www.rtcoproxy.com/pwod or by telephone by calling 1-855-667-0872 (toll-free) on a touch-tone phone and using the control number located on the proxy card. If your shares are registered in the name of a broker or other nominee, your nominee may be participating in a program provided through ADP Investor Communication Services that allows you to vote via the Internet. If so, the voting form your nominee sends you will provide voting instructions.

You may access the following proxy materials at http://www.cfpproxy.com/4823:

·

Notice of the

20122014 Annual Meeting of Shareholders;

·the 2012

2014 Proxy

Statement of the Corporation;·the Corporation’s Statement;

Annual Report to Shareholders for the year ended December 31,

2011;2013; and

·

You are cordially invited to attend the Annual Meeting. The giving of such proxy does not affect your right to vote in person at the Annual Meeting, if you give written notice to the Secretary of the Corporation of your intention to vote at the Annual Meeting.

By Order of the Board of Directors,

| |

Richard A. Grafmyre

| |

President and Chief Executive Officer

| |

| |

| |

Dated: March 21, 2012

| |

Richard A. Grafmyre

President and Chief Executive Officer

Dated: March 26, 2014

Important Notice Regarding Availability of Proxy Materials for the

Annual Meeting of Shareholders to be held on Wednesday, April

25, 201230, 2014

The Proxy Statement and Annual Report to Shareholders for the year ended

December 31,

20112013 are available at http://www.cfpproxy.com/4823.

PENNS WOODS BANCORP, INC.

300 Market Street

PROXY STATEMENT FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD WEDNESDAY, APRIL

25, 2012

Introduction;30, 2014

Introduction: Date, Time, and Place of Annual Meeting

This proxy statement is being furnished in connection with the solicitation by the

Boardboard of

Directorsdirectors of PENNS WOODS BANCORP, INC. (the “Corporation”), a Pennsylvania business corporation, of proxies to be voted at the Annual Meeting (the “Annual Meeting”) of holders of Common Stock (the “Common Stock”) of the Corporation to be held on Wednesday, April

25, 2012,30, 2014, at 1:00 P.M., at the

HolidayPine Barn Inn,

Williamsport, 1001 Pine

Street, Williamsport,Barn Place, Danville, PA

17701,17821, and any adjournment or postponement thereof.

The principal executive office of the Corporation is located at 300 Market Street, Williamsport, PA 17701. All inquiries should be directed to Richard A. Grafmyre, President of the Corporation, at (570) 322-1111. Jersey Shore State Bank

(the “Bank”(“JSSB”)

is aand Luzerne Bank ("Luzerne", together referred to as the "Banks") are wholly owned

subsidiarysubsidiaries of the Corporation.

Solicitation and Revocability of Proxies

This proxy statement and enclosed proxy card are first being sent to shareholders of the Corporation on or about March 21, 2012.26, 2014. Shares represented by the proxy, if properly signed and returned, will be voted in accordance with the specifications made thereon by the shareholders. Any proxy not specifying to the contrary will be voted “FOR” the Class 23 nominees noted, “FOR” the proposalamendment to amend the Corporation’s articlesArticles of incorporationIncorporation to increasereduce shareholder vote necessary to approve acquisitions of other companies, "FOR" the number of authorized shares of common stock from 10,000,000 to 15,000,000, “FOR” the proposal to amend the Corporation’s articles of incorporation to authorize 3,000,000 shares of preferred stock,2014 Penns Woods Bancorp, Inc. Stock Incentive Plan, and “FOR” the ratification of the appointment of S.R. Snodgrass, A.C., Certified Public Accountants, as the independent registered public accounting firm of the Corporation for the year ending December 31, 2012.2014. The execution and return of the enclosed proxy card will not affect the right of a shareholder of record to attend the Annual Meeting and to vote in person if such shareholder gives written notice to the Secretary of the Corporation.

The cost of assembling, printing, mailing, and soliciting proxies and any additional material that the Corporation may furnish shareholders in connection with the Annual Meeting will be borne by the Corporation. In addition to the solicitation of proxies by use of the mails, directors, officers, and employees of the Corporation and/or the Bank may solicit proxies by telephone, telegraph, or personal interview, with nominal expense to the Corporation. The Corporation

has engaged AST Phoenix Advisors, a professional proxy solicitor (“AST”), to assist Penns Woods in connection with the solicitation of proxies for the Annual Meeting. The Corporation has agreed to pay AST a fee of $6,500 for its services and to reimburse AST for any out-of-pocket expenses incurred by AST in connection with such services. In the event AST is requested to implement a telephone solicitation of shareholders, AST will be entitled to a fee of $4.50 per call. In addition, the Corporation has agreed to indemnify AST from and against any and all claims, costs, damages, liabilities, judgments and expenses which result from claims and other proceedings brought against AST that directly relate to or arise out of the services performed by AST. The Corporation will also pay the standard charges and expenses of brokerage houses or other nominees or fiduciaries for forwarding proxy soliciting material to the beneficial owners of shares.

A shareholder of record who returns a proxy may revoke the proxy at any time before it is voted (1) by giving written notice of revocation to Richard A. Grafmyre, President and Chief Executive Officer, Penns Woods Bancorp, Inc., 300 Market Street, Williamsport, PA 17701, (2) by executing a later-dated proxy and giving written notice thereof to the Secretary of the Corporation, or (3) by voting in person after giving written notice to the President of the Corporation.

If your shares are held in “street name” (that is, through a broker, trustee, or other holder of record), you will receive a proxy card from your broker seeking instructions as to how your shares should be voted. If no voting instructions are given, your broker or nominee has discretionary authority to vote your shares on your behalf on certain routine matters. A “broker non-vote” results on a matter when your broker or nominee returns a proxy but does not vote on a particular proposal because it does not have discretionary authority to vote on that proposal and has not received voting instructions from you. Under the rules of The New York Stock Exchange, only Proposal No. 4 (the ratification of the appointment of the Corporation’s independent registered public accounting firm) is a routine matter, and therefore is the only proposal for which your broker or nominee has discretionary authority to vote. Your broker or nominee does not have discretionary authority to vote on Proposal No. 1 (the election of the threefour Class 23 directors), Proposal No. 2 (the proposal(amendment to amend the articlesArticles of incorporationIncorporation to increase the numberreduce shareholder vote necessary to approve acquisitions of authorized shares of common stock)other

companies),

orand Proposal No. 3

(the proposal to amend the articles of incorporation to authorize preferred stock)(2014 Penns Woods Bancorp, Inc. Stock Incentive Plan). You may not vote shares held in “street name” at the Annual Meeting unless you obtain a legal proxy from your broker or holder of record.

Under the Corporation’s bylaws, the presence, in person or by proxy, of shareholders entitled to cast at least a majority of the votes which all shareholders are entitled to cast will constitute a quorum for transaction of business at the Annual Meeting.

Holders of record of the common stock at the close of business on March

1, 20123, 2014 will be entitled to notice of and to vote at the Annual Meeting. On March

1, 20123, 2014 there were

3,835,4334,819,367 shares of common stock outstanding. Each share of the common stock outstanding as of

1

the close of business on March 1, 2012,3, 2014, is entitled to one vote on each matter that comes before the meeting and holders do not have cumulative voting rights with respect to the election of directors.

Under Pennsylvania law and the Bylaws of the Corporation, the presence of a quorum is required for each matter to be acted

uponon at the Annual Meeting.

For purposes of the Annual Meeting, a quorum consists of the presence, in person or by proxy, of shareholders entitled to cast at least a majority of the votes which all shareholders are entitled to cast. Votes withheld, abstentions and broker non-votes will be counted in determining the presence of a quorum for

the particulareach matter.

Assuming the presence of a quorum, the

threefour nominees for director receiving the highest number of votes cast by shareholders entitled to vote for the election of directors shall be elected. Votes withheld from a

particular nominee and broker non-votes will not constitute or be counted as votes cast for such nominee.

Assuming the presence of a quorum, the affirmative vote of

holders of 66-2/3% of the Corporation’s outstanding common stock is required for approval of the proposal to amend the Corporation’s articles of incorporation. The affirmative vote of a majority of

all votes cast by shareholders at the Annual Meeting is required for the other

non-election matters to be considered at the Annual Meeting. Abstentions will not constitute or be counted as votes cast, and therefore, will

act as negative votes on the proposal to amend the Corporation’s articles of incorporation, but will not affect the outcome

ofon the

vote on theseother non-election matters.

All proxies properly executed and not revoked will be voted as specified.

THE BOARD OF DIRECTORS AND ITS COMMITTEES

The Corporation maintained the following standing committees for

2011,2013, the current members of which are as follows:

|

|

|

|

|

|

| | | | Number of Times

Met During 20112013 |

AUDIT: | | Daniel K. Brewer, William J. Edwards, James M. Furey, II, D. Michael Hawbaker, Leroy H. Keiler, III, John G. Nackley, R. Edward Nestlerode, Jr. | | 4 |

| | | | |

| EXECUTIVE: | | Michael J. Casale, Jr., Joseph E. Kluger, R. Edward Nestlerode, Jr., Hubert A. Valencik | | — |

| | | | |

| JSSB maintained the following standing committees for 2013, the current members of which are as follows: |

| | | | |

| AUDIT: | | Daniel K. Brewer, William J. Edwards, James M. Furey, II, D. Michael Hawbaker, Leroy H. Keiler, III, R. Edward Nestlerode, Jr. | | 4 |

| | | | |

EXECUTIVE:BUILDING &INSURANCE:

| | Michael J. Casale, Jr., James M. Furey, II, Leroy H. Thomas Davis,Keiler, III, Hubert A. Valencik | | 1 |

| | | | |

| EXECUTIVE: | | Michael J. Casale, Jr., James M. Furey, II, R. Edward Nestlerode, Jr., Hubert A. Valencik | | 0

— |

| | | | |

The Bank maintained the following standing committees for 2011, the current members of which are as follows:

COMPENSATION & BENEFITS: | | |

| | | | |

AUDIT:

| | James M. Furey, II, D. Michael Hawbaker, Leroy H. Keiler, III, R. Edward Nestlerode, Jr.

| | 4

|

| | | | |

BUILDING & INSURANCE:

| | Michael J. Casale, Jr., H. Thomas Davis, Jr., James M. Furey, II, Leroy H. Keiler, III, Hubert A. Valencik | | 1

|

| | | | |

EXECUTIVE:

| | Michael J. Casale, Jr., H. Thomas Davis, Jr., James M. Furey, II, R. Edward Nestlerode, Jr., Hubert A. Valencik

| | 0

|

| | | | |

COMPENSATION & BENEFITS:

| | Michael J. Casale, Jr., H. Thomas Davis, Jr., D. Michael Hawbaker, R. Edward Nestlerode, Jr.

| | 1 |

| | | | |

ASSET LIABILITY: | | Daniel K. Brewer, William J. Edwards, James M. Furey, II, D. Michael Hawbaker, Leroy H. Keiler, III, William H. Rockey, Hubert A. Valencik, Ronald A. Walko, Richard A. Grafmyre, Robert J. Glunk, Brian L. Knepp, Ann M. Riles, Janine E. Packer Misty D. Mark | | 4 |

| | (Mr. Glunk, Mr. Knepp Ms. Riles, and Ms. PackerMark are employees of JSSB.) | | |

| | | | |

Luzerne maintained the Bank.)following standing committees from June 1, 2013 to December 31, 2013, the current members of which are as follows: |

| | | | |

| AUDIT: | | Patricia Finan Castellano, James Clemente, Gary F. Lamont, Robert G. Lawrence, Angelo C. Terrana, Jr. | | 1 |

| | | | |

| COMPENSATION & BENEFITS: | | Gary F. Lamont, John G. Nackley, Jill Fortinsky Schwartz, William Strauser | | 5 |

| | | | |

| Loan Committee | | Patricia Fnan Castellano, James Clemente, Robet J. Glunk, Richard A. Grafmyre, Joseph E. Kluger, Gary F. Lamont, Robert G. Lawrence, John G. Nackley, Jill Fortinsky Schwartz, William Strauser, Angelo C. Terrana, Jr. | | 2 |

The Audit Committee of the Corporation was composed of five (5)seven (7) independent directors within the meaning of the NASDAQ listing standards during 2011, and will be composed of four (4) independent directors during 2012 as a result of the death of Director James E. Plummer, who served asstandards. John G. Nackley joined the Audit Committee Financial Expert.following the acquisition of Luzerne during 2013. The Audit Committee operates under a written charter, a copy of which is available on our website, www.jssb.com, under Investor Relations/ Financial Information/ Governance Documents and is available upon written request to the President. The Boardboard of Directorsdirectors has designated R. Edward Nestlerode, Jr.Daniel K. Brewer as the Audit Committee financial expert. The Audit Committee is responsible for the appointment, compensation, oversight, and termination of the Corporation’s independent auditors. The Audit Committee is required to pre-approve audit and certain non-audit services performed by the independent auditors. The Audit Committee also assists the Boardboard of Directorsdirectors in providing oversight over the integrity of the Corporation’s financial statements, compliance with applicable legal and regulatory requirements, and the performance of our internal audit function. The Audit Committee also is responsible for, among other things, reporting to the Boardboard of Directorsdirectors on the results of the annual audit and reviewing the financial statements

and related financial and non-financial disclosures included in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Importantly, from a corporate governance perspective, the Audit Committee regularly evaluates the independent auditors’

2

independence, including approving consulting and other legally permitted, non-audit services provided by the auditors and the potential impact of the services on the auditors’ independence. The Audit Committee meets periodically with the independent auditors and the internal auditors outside of the presence of management, and possesses the authority to retain professionals to assist it in meeting its responsibilities without consulting with management. The Audit Committee reviews and discusses with management earnings releases, including the use of pro forma information. The Audit Committee also discusses with management and the independent auditors the effect of accounting initiatives. The Audit Committee also is responsible for receiving and retaining complaints and concerns relating to accounting and auditing matters.

The

Boardboard of

Directorsdirectors of the Corporation met

nine (9)fourteen (14) times during

2011.2013. The

Boardboard of

Directorsdirectors of

the BankJSSB met

twenty-six (26)twenty-four (24) times during

2011.2013, while the Luzerne board of directors met eight (8) times. All of the Directors attended at least 75% of the aggregate of all meetings of the

Boardboard of

Directorsdirectors and the Committees of which they were members.

Board Leadership Structure

Our

Boardboard of

Directorsdirectors maintains the freedom to choose whether the roles of Chairman of the Board and Chief Executive Officer should be combined or separated, based on what it believes is best for the Corporation and its shareholders at any given time. The

Boardboard of

Directorsdirectors has determined that it is appropriate to separate the roles of Chief Executive Officer and Chairman of the

Board.Board for both the Corporation and its banking subsidiaries. Accordingly,

Ronald A. WalkoR. Edward Nestlerode, Jr. serves as Chairman of the Board of the Corporation,

Hubert A. Valencik serves as Chairman of the Board of JSSB, and

Bank,Joseph E. Kluger serves as Chairman of the Board of Luzerne while Richard A. Grafmyre serves as Chief Executive Officer of the Corporation and

Bank.JSSB and Robert J. Glunk serves as Chief Executive Officer of Luzerne. The

Boardboard of

Directorsdirectors believes this arrangement provides stronger corporate governance and conforms to industry best practices.

Each member of the

Boardboard of

Directorsdirectors has a responsibility to monitor and manage risks faced by the Corporation. At a minimum, this requires the members of the

Boardboard of

Directorsdirectors to be actively engaged in board discussions, review materials provided to them, and know when it is appropriate to request further information from management and/or engage the assistance of outside advisors. Furthermore, because the banking industry is highly regulated, certain risks to the Corporation are monitored by the

Boardboard of

Directorsdirectors through its review of the Corporation’s,

JSSB's, and

the Bank’sLuzerne's compliance with regulations set forth by the banking regulatory authorities. Because risk oversight is a responsibility for each member of the

Boardboard of

Directors,directors, the

Board’sboard’s responsibility for risk oversight is not concentrated into a single committee. Instead, oversight is delegated, to a large degree, to the various board committees with an independent director serving in the capacity of committee chairman. These committees meet formally, as needed, to discuss risks and monitor specific areas of the Corporation’s performance with their findings reported at the next scheduled full meeting of the

Boardboard of

Directors.directors. In addition, the composition of the

Boardboard of

Directorsdirectors and normal agenda allow for the continuous oversight of risk by providing an environment which encourages the directors to ask specific questions or raise concerns and allots them sufficient time and materials to do so effectively. The overlap of committee membership provides a broad perspective of various risks and the actions undertaken to manage risks in today’s environment.

In the view of the Boardboard of Directors,directors, all directors who are independent within the meaning of the NASDAQ listing standards should participate in the selection of director nominees. Accordingly, all directors, except for Messrs. Walko Rockey, and Grafmyre, participate in the selection of director nominees. Directors who participate in the selection of director nominees operate under a written charter, a copy of which is available on our website, www.jssb.com, under Investor Relations/Financial Information/Governance Documents and is available upon request to the President. Independent directors considering the selection of director nominees will consider candidates recommended by shareholders. Shareholders desiring to submit a candidate for consideration as a nominee of the Boardboard of Directorsdirectors must submit the same information with regard to the candidate as that required to be included in the Corporation’s proxy statement with respect to nominees of the Boardboard of Directorsdirectors in addition to any information required by the Bylaws of the Corporation. Shareholder recommendations should be submitted in writing to Penns Woods Bancorp, Inc., 300 Market Street, Williamsport, PA 17701 (Attention: President and Chief Executive Officer), on or before December 31 of the year preceding the year in which the shareholder desires the candidate to be considered as a nominee. Although the Boardboard of Directorsdirectors at this time does not utilize any specific written qualifications, guidelines, or policies in connection with the selection of director nominees, candidates must have a general understanding of the financial services industry or otherwise be able to provide some form of benefit to the Corporation’s business, possess the skills and capacity necessary to provide strategic direction to the Corporation, be willing to represent the interests of all shareholders, be able to work in a collegial board environment, and be available to devote the necessary time to the business of the Corporation. In addition to these requirements, candidates will be

considered on the basis of diversity of experience, skills, qualifications, occupations, education, and backgrounds, and whether the candidate’s skills and experience are complementary to the skills and experience of other

Boardboard members. Candidates recommended by shareholders will be evaluated on the same basis as candidates recommended by the independent directors.

Nominations for director to be made at the Annual Meeting by shareholders entitled to vote for the election of directors must be submitted to the Secretary of the Corporation not less than ninety (90) days or more than one hundred fifty (150) days prior to the Annual Meeting, which notice must contain certain information specified in the Bylaws. No notice of nomination for election as a director has been received from any shareholder as of the date of this proxy statement. If a nomination is attempted at the Annual Meeting that does not comply with

3

the procedures required by the Bylaws or if any votes are cast at the Annual Meeting for any candidate not duly nominated, then such nomination and/or such votes may be disregarded.

COMPENSATION OF DIRECTORS

Director Compensation Table

| | | | | | | | | | Change in Pension | | | | | |

| | Fees | | | | | | | | Value and | | | | | |

| | Earned or | | | | | | Non-Equity | | Nonqualified Deferred | | | | | |

| | Paid in | | Stock | | Option | | Incentive Plan | | Compensation | | All Other | | | |

| | Cash | | Awards | | Awards | | Compensation | | Earnings | | Compensation | | Total | |

Name | | ($) | | ($) | | ($) | | ($) | | ($)(1) | | ($) | | ($) | |

Michael J. Casale, Jr. | | $ | 37,200 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 37,200 | |

H. Thomas Davis, Jr. | | 33,400 | | — | | — | | — | | — | | — | | 33,400 | |

James M. Furey, II | | 41,200 | | — | | — | | — | | — | | — | | 41,200 | |

D. Michael Hawbaker | | 39,200 | | — | | — | | — | | — | | — | | 39,200 | |

Leroy H. Keiler, III | | 41,900 | | — | | — | | — | | — | | — | | 41,900 | |

R. Edward Nestlerode, Jr. | | 37,700 | | — | | — | | — | | — | | — | | 37,700 | |

James E. Plummer | | 45,400 | | — | | — | | — | | — | | — | | 45,400 | |

William H. Rockey | | 39,200 | | — | | — | | — | | — | | — | | 39,200 | |

Hubert A. Valencik | | 41,200 | | — | | — | | — | | — | | — | | 41,200 | |

Ronald A. Walko | | 35,400 | | — | | — | | — | | — | | — | | 35,400 | |

| | | | | | | | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fees Earned or Paid in Cash | | Stock Awards | | Option Awards | | Non-Equity Incentive Plan Compensation | | Change in Pension Value and Non-qualified Deferred Compensation Earnings | | All Other Compensation | | Total |

| Name | | ($) | | ($) | | ($) | | ($) | | ($) | | ($)(1) | | ($) |

| Daniel K. Brewer | | $ | 50,200 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 50,200 |

|

| Michael J. Casale, Jr. | | 45,700 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 45,700 |

|

| William J. Edwards | | 49,700 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 49,700 |

|

| James M. Furey, II | | 49,700 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 49,700 |

|

| D. Michael Hawbaker | | 49,700 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 49,700 |

|

| Leroy H. Keiler, III | | 54,800 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 54,800 |

|

| Joseph E. Kluger | | 30,283 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 30,283 |

|

| John G. Nackley | | 24,517 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 24,517 |

|

| R. Edward Nestlerode, Jr. | | 49,700 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 49,700 |

|

| William H. Rockey | | 48,200 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 48,200 |

|

| Jill F. Schwartz | | 24,017 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 24,017 |

|

| Hubert A. Valencik | | 48,700 |

| | — |

| | — |

| | — |

| | — |

| | 34,654 |

| | 83,354 |

|

| Ronald A. Walko | | 46,800 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 46,800 |

|

(1)Represents portion, if any,earnings from consulting agreement (described in detail below) and an additional $17,854 for health insurance benefits.

In connection with his retirement, Mr. Valencik and the Corporation entered into a consulting letter agreement, effective August 1, 2005. Under the agreement, Mr. Valencik will continue to perform certain consulting services for the Corporation, principally in the area of

interest creditedbusiness development. The agreement renews on each August 1, subject to either party’s right to terminate the agreement upon 45 days’ prior written notice. During the term of the consulting agreement, Mr. Valencik will be required to devote not more than 20 hours per week to the

director’s deferred fee account which exceeds 120%provision of consulting services. In consideration of the

applicable federal rateconsulting services, he will be paid $1,400 per month and will be reimbursed for the after-tax cost of health insurance if he is then ineligible for coverage under the

Internal Revenue Code. The director fee agreements are described below.Corporation’s health insurance programs.

The Corporation paid a $10,000$15,000 retainer fee to each director of the Corporation during 2011.2013 (prorated for directors Kluger, Nackley, and Schwartz for 2013 from the date of the acquisition of Luzerne). Mr. Nestlerode and Mr. Valencik each received $1,500 for serving as Chairman of the Board for the Corporation and JSSB, respectively. All directors of the BankJSSB received $1,000$1,200 for each meeting of the Boardboard of Directorsdirectors of the Bank,JSSB, $500 for each Audit or Asset Liability Committee meeting, and $400 for all other committee meetings of the Boardboard of Directorsdirectors of the BankJSSB that the director attended during 2011.2013. In addition, directors of JSSB receive compensation for accompanying an officer on property appraisals at a rate of $20 for the first hour and $10 for each subsequent hour. The director serving as the Secretary of the Boardboard of Directorsdirectors for JSSB receives $200 per meeting. Mr. Kluger served as the Chairman of the Board of Luzerne and was paid a monthly retainer of $1,833 for his services as such. Mr. Nackley, and Ms. Schwartz served on the board of directors of Luzerne and received a monthly retainer of $667 for their service. In addition, the board members of Luzerne received $800 per board meeting and $400 per committee meeting attended. In the aggregate, the

existing

Boardboard of

Directorsdirectors of the Corporation earned

$391,800$572,017 for all

Boardboard and committee meetings of the Corporation and the Bank attended. This total also includes the total received for appraisals and the secretarial function. A portion of fees earned are used to fund a deferred compensation plan for the directors who

participatedparticipate in this plan.

The Bank

JSSB and Directors Casale, Furey, Rockey, and Walko have entered into director fee agreements pursuant to which each participating director may defer payment of all or a portion of his director’s fees earned for service on the

Boardsboards of

Directorsdirectors of the Corporation and

the Bank. The BankJSSB. JSSB has established a deferral account for each participating director on its books. Benefits are funded by each director’s fees and

the Bank’sJSSB’s general assets and are payable upon retirement, early termination, disability, death, or the occurrence of a change in control of the Corporation or

the Bank.JSSB. Interest is credited to each deferral account at an annual rate equal to 50% of the Corporation’s return on equity for the immediately prior year, compounded monthly. Following termination of service, interest is credited to a deferral account at a rate based on the yield of the 10-year treasury note. A participating director may receive a benefit if the

Boardboard of

Directorsdirectors has determined

4

that, following a request by a participating director, such director has suffered a severe unforeseeable financial hardship and becomes payable at the Boardboard of Directorsdirectors discretion. Generally, the payments are payable, at the participating director’s prior election, in a lump sum or in 60 equal monthly installments. Following the occurrence of a triggering event, payments will commence within 30 days after, at the participating director’s prior election, his retirement or termination of service, or the occurrence of a change in control of the Corporation or the Bank.JSSB. If payments were not triggered until the participating director’s death, the benefits will be paid within 90 days following receipt of the director’s death certificate.

Mr. Grafmyre did not receive any director fees during

2011.2013. Commencing in 2011, employee directors elected to the

Boardboard for the first time during 2010 and in any year thereafter (including Mr. Grafmyre) will not receive any separate compensation for serving as a director of the Corporation,

JSSB, or

the Bank.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Directors Casale, Davis, Furey, Hawbaker, Keiler, Nestlerode, and Valencik have lending relationships with the Bank, our wholly owned banking subsidiary, which were made, and presently are, in compliance with Regulation O under the federal banking laws. For more information relating to loans to our directors, see “Certain Transactions.” With these exceptions, no member of the Compensation and Benefits Committee (i) was, during the 2011 fiscal year, or had previously been, an officer or employee of the Corporation or its subsidiaries or (ii) had any direct or indirect material interest in a transaction of the Corporation or a business relationship with the Corporation, in each case that would require disclosure under applicable rules of the SEC. No other interlocking relationship existed between any member of the Compensation and Benefits Committee or an executive officer of the Corporation, on the one hand, and any member of the Compensation Committee (or committee performing equivalent functions, or the full Board of Directors) or an executive officer of any other entity, on the other hand, requiring disclosure pursuant to the applicable rules of the SEC.

Luzerne.

PROPOSAL NO. 1

The

bylawsBylaws provide that the

Boardboard of

Directorsdirectors shall consist of not less than five (5) nor more than twenty-five (25) directors who are shareholders, the exact number to be fixed and determined from time to time by resolution of the full

Boardboard of

Directorsdirectors or by resolution of the shareholders at any annual or special

meeting.meeting with the number currently set at fourteen (14). The Articles of Incorporation and Bylaws further provide that the directors shall be divided into three (3) classes, as nearly equal in number as possible, known as Class 1, Class 2, and Class 3. The directors of each class serve for a term of three (3) years and until their successors are elected and qualified. Under Pennsylvania law, directors of the Corporation can be removed from office by a vote of shareholders only for cause.

Following the death of Director James E. Plummer in 2011, Director Ronald A.Walko moved from Class 1 to Class 2 to maintain each class as nearly equal in number as possible as required by Pennsylvania law and the Corporation’s articles of incorporation and bylaws, and the Board of Directors set the number of directors at ten (10). The directors of the Corporation serve as follows:

|

| | | | |

Nominees for election of Class 23 |

| Class 3 Directors

|

| Class 1 Directors | | Class 2 Directors |

Directors whose term expires in 2015: 2017: |

| to serve until 2014: 2016: |

| to serve until 2013: 2015: |

James M. Furey, II (age 66) | | Daniel K. Brewer (age 51) | | William J. Edwards (age 42) |

| Richard A. Grafmyre (age 60) | | Michael J. Casale, Jr. (age 62) | | Leroy H. Keiler, III (age 48)50) |

| D. Michael Hawbaker (age 46) | | H. Thomas Davis, Jr.Joseph E. Kluger (age 63)

50) | | Michael J. Casale, Jr.Jill F. Schwartz (age 60)

|

Hubert A. ValencikJohn G. Nackley (age 70)

61) | | James M. Furey, II (age 64)

| | R. Edward Nestlerode, Jr. (age 59) 61) | | Hubert A. Valencik (age 72) |

| | William H. Rockey (age 67) | | Ronald A. Walko (age 65) | | Richard A. Grafmyre (age 58)

| | William H. Rockey (age 65)

|

| | D. Michael Hawbaker (age 44)

| | 67) |

The

Boardboard of

Directorsdirectors has affirmatively determined that all of the

Corporation’s directors are independent within the meaning of the NASDAQ listing standards, except for Ronald A. Walko

Chairman of the Board and former President and Chief Executive Officer of the Corporation and

the Bank, William H. Rockey, former Senior Vice President of the Corporation and the Bank,JSSB and Richard A. Grafmyre, President and Chief Executive Officer of the Corporation and

the Bank.JSSB. The

Boardboard categorically determined that a lending relationship resulting from a loan made by the Bank to a director would not affect the determination of independence if the loan complies with Regulation O under the federal banking laws. The

Boardboard also categorically determined that maintaining with the Bank a deposit, savings, or similar account by a director or any of the director’s affiliates would not affect the determination of independence if the account is maintained on the same terms and conditions as those available to similarly situated customers.

The proxies solicited hereunder will be voted “FOR” (unless otherwise directed) the

three (3)four (4) director nominees of the

Boardboard of

Directorsdirectors listed previously for election as Class

23 directors. Each nominee has agreed to serve if elected and qualified. The Corporation does not contemplate that any nominee will be unable to serve as a director for any reason. However, in the event one or more of the nominees should be unable to stand for election, proxies will be voted for the remaining nominees and such other persons selected by the

Boardboard of

Directors,directors, in accordance with the best judgment of the proxy holders.

5

INFORMATION AS TO NOMINEES AND DIRECTORS

Set forth below is the principal occupation and certain other information regarding the nominees and other directors whose terms of office will continue after the annual meeting. In addition, below we provide the particular experience, qualification, attributes, or skills that led the

Boardboard of

Directorsdirectors to conclude that each director and nominee should serve as a director. Share ownership information for each director and nominee is included under “Beneficial Ownership and Other Information Regarding Directors and Management.”

NOMINEES FOR DIRECTOR

Leroy H. Keiler, III operates Leroy H. Keiler, Attorney at Law. Mr. Keiler has served as a director of the Corporation since 2006. Because banking is a highly regulated industry and success in the industry is dependent on adequately managing certain lending risks, Mr. Keiler’s experience as an attorney is helpful to the Board in reviewing the Bank’s legal matters and documentation related to residential lending matters. Additionally, Mr. Keiler’s relatively younger age adds to the diversity of the Board and helps to ensure that the Board will develop Board members with a depth of knowledge of the Corporation and the Bank, in order to avoid knowledge and experience voids as older Board members retire.

Hubert A. Valencik is a retired former Senior Vice President and Chief Operations Officer of the Bank and Senior Vice President of the Corporation. Mr. Valencik has served as a director of the Corporation since 2005. As the former Chief Operations Officer of the Bank, Mr. Valencik continues to provide the Board valuable insight and information regarding the operations of the Bank, which assists the Board in providing adequate levels of management oversight.

Ronald A. Walko is the Chairman of the Board of the Corporation and the Bank. He joined the Bank in 1986 as Vice President and Senior Loan Officer. He was elected Executive Vice President and Chief Executive Officer of Penns Woods Bancorp, Inc. and the Bank in May 1999, and served as the President and Chief Executive Officer of Penns Woods Bancorp, Inc. and the Bank from August 2000 until October 2010. With 25 plus years of service with the Bank, Mr. Walko possesses a deep understanding of the Bank’s.

DIRECTORS CONTINUING IN OFFICE

Michael J. Casale, Jr. is the principal of Michael J. Casale, Jr., Esq., LLC. Mr. Casale has served as a director of the Corporation since 1999. Because banking is a highly regulated industry and success in the industry is dependent on adequately managing certain lending risks, Mr. Casale’s experience as an attorney is helpful to the Board in reviewing the Bank’s legal matters and documentation related to commercial lending matters.

H. Thomas Davis, Jr. is Chairman and Chief Executive Officer of Davis Insurance Agency, Inc. a provider of property and casualty insurance. Mr. Davis has served as a director of the Corporation since 1999. Mr. Davis’ extensive knowledge of the insurance industry remains important to the Board for its oversight of the Bank’s wholly owned subsidiary, The M Group, Inc., d/b/a The Comprehensive Financial Group, which sells insurance products.

James M. Furey, II is President and owner of Eastern Wood Products. Mr. Furey has served as a director of the Corporation since 1990. Through Mr. Furey’s professional experience in the lumber industry, which is significant in the Williamsport region, he has developed strong ties to the community there, which remains the Bank’s primary market.community. From these community relationships, Mr. Furey provides the Boardboard with insight as to the growth opportunities and real estate industry within the Williamsport region.

Richard A. Grafmyre has served as President and Chief Executive Officer of the Corporation and the BankJSSB since joining the Corporation in October 2010. Prior to joining the Corporation, Mr. Grafmyre served as President, Chief Executive Officer, and Chairman of FNB Bank since 1997. For the efficient operation of the Board,board, the Boardboard believes that the President and Chief Executive Officer should have a position on the Boardboard to act as a liaison between the Boardboard and management and to assist with the Board’sboard’s oversight responsibilities by ensuring the Boardboard receives information from management in a timely and accurate manner to permit the Boardboard to carry out its responsibilities effectively. Mr. Grafmyre’s extensive professional banking experience within a larger holding company structure enables him to provide the Boardboard with insight as to how the Bank’s operations, policies, and implementation of strategic plans compare to those of its peers.

D. Michael Hawbaker is Executive Vice President of Glenn O. Hawbaker, Inc., a provider of heavy construction services and products throughout the company’s market area in Centre County, Pennsylvania. Mr. Hawbaker has served as a director of the Corporation since 2007. Mr. Hawbaker asis one of our youngest Board member,board members, adds to the diversity of the Boardboard, and helps to ensure that the Boardboard will develop Boardboard members with a depth of knowledge of the Corporation and the Bank, in order to avoid knowledge and experience voids as older Boardboard members retire. Additionally, Mr. Hawbaker understands the community and political landscape of the Centre County area where the Boardboard intends to continue to grow the Bank’s business. Mr. Hawbaker possesses a level of financial acumen important to his service as a member of the Audit Committee.

6John G. Nackley is President & CEO, InterMetro Industries Corporation, a division of Emerson, after serving as Vice President and Executive Vice President.Mr. Nackley has served as a director since 2013 and has served on Luzerne’s board of directors since 2007. Mr. Nackley’s experience in a Fortune 500 company provides the board with leadership in the business climate, financial reporting, strategic planning, marketing, and governance.

DIRECTORS CONTINUING IN OFFICE

Daniel K. Brewer is a Certified Public Accountant and the principal and owner of Brewer & Company, LLC, a private CPA firm. Mr. Brewer’s experience and knowledge of financial standards and reporting is valuable to the Audit Committee of which he serves as the Chairman. Mr. Brewer’s business and social involvement in the greater area of Columbia and Montour Counties provides insight into the economic stability surrounding our newest office located in Danville, Montour County. In addition, Mr. Brewer’s knowledge of financial statements assists the board in their review of certain loan requests.

Michael J. Casale, Jr. is the principal of Michael J. Casale, Jr., Esq., LLC. Mr. Casale has served as a director since 1999. Because banking is a highly regulated industry and success in the industry is dependent on adequately managing certain lending risks, Mr. Casale’s experience as an attorney is helpful to the board in reviewing the Bank’s legal matters and documentation related to commercial lending matters.

William J. Edwards is President and owner of JEB Environmental Technologies, Inc., a storage tank construction company. Mr. Edwards has served as a director since 2012. Mr. Edwards, our youngest board member, adds to the diversity of the board and helps to ensure that the board will develop board members with a depth of knowledge of the Corporation and the Bank, in order to avoid knowledge and experience voids as older board members retire. In addition, Mr. Edwards’ business involvement in various communities provides insight into the economic health of the communities, while also providing insight into potential customer relationships.

Leroy H. Keiler, III operates Leroy H. Keiler, Attorney at Law. Mr. Keiler has served as a director since 2006. Because banking is a highly regulated industry and success in the industry is dependent on adequately managing certain lending risks, Mr. Keiler’s

experience as an attorney is helpful to the board in reviewing the Bank’s legal matters and documentation related to residential lending matters. Additionally, Mr. Keiler’s relatively younger age adds to the diversity of the board and helps to ensure that the board will develop board members with a depth of knowledge of the Corporation and the Bank, in order to promote continuity in the board.

Joseph E. Kluger is one of two Managing Partners of Hourigan, Kluger & Quinn P.C., where he has practiced law primarily in the fields of corporate finance, real estate, and for-profit and not-for-profit corporate and business law for more than 22 years. Mr. Kluger has served as a director since 2013 and has served on Luzerne’s board of directors since 2006 and serving as the Chairman of the Board since 2007. Mr. Kluger’s experience as an attorney is helpful to the board in reviewing the Bank’s legal matters, corporate governance issues, and documentation related to the lending process and workout matters.

R. Edward Nestlerode, Jr. is athe Chairman of the Board of the Corporation and is Vice President and Chief Executive Officer of Nestlerode Contracting Co., Inc., which specializes in bridge building. Mr. Nestlerode has served as a director of the Corporation since 1995. Mr. Nestlerode maintains strong community ties in the Clinton County area, which is a region that the Bank intends to grow its business. Through his business, Mr. Nestlerode has developed knowledge of the construction industry, which provides the Boardboard with insight regarding the development of potential customer relationships and opportunities for the Bank. In addition, Mr. Nestlerode’s previous experience as a Chief Financial Officer is valuable as a member of the Audit Committee.

William H. Rockey is a retired former Senior Vice President of the Corporation and the Bank.JSSB. He was the president of the former First National Bank of Spring Mills. Mr. Rockey has served as a director of the Corporation since 1999. Mr. Rockey’s ties to Centre County, Pennsylvania will assist the Bank in growing its business in the Centre County region. In addition, Mr. Rockey’s former position with the Corporation, along with his long-time professional banking experience in Centre County, Pennsylvania, combined with his knowledge and familiarity of the Bank’s culture and operating procedures, provide the Boardboard with significant business development resources and experience.

Jill F. Schwartz is the senior partner of Wyoming Weavers, Swoyersville, PA and Vice President of Fortune Fabrics, Inc., positions she has held since 1985. She is also the owner of Gosh Yarn It!, a yarn boutique located in Kingston, PA. Ms. Schwartz has served as a director since 2013 and has served on Luzerne’s board of directors since 2006 and currently serves as the Vice Chairman. As president of a local manufacturing company along with many years of experience as a bank director, Ms. Schwartz provides the board with an understanding of the local business climate and growth opportunities for the Bank.

Hubert A. Valencik is the Chairman of the Board of JSSB and is a retired former Senior Vice President and Chief Operations Officer of JSSB and Senior Vice President of the Corporation. Mr. Valencik has served as a director since 2005. As the former Chief Operations Officer of JSSB, Mr. Valencik continues to provide the board valuable insight and information regarding the operations of the Bank, which assists the board in providing adequate levels of management oversight.

Ronald A. Walko is a retired President and Chief Executive Officer of the Corporation and JSSB. Mr. Walko remains active in various civic organization's in the Williamsport area. With 25 plus years of service with JSSB, Mr. Walko possesses a deep understanding of the Bank’s operations, which assists the board in strategic planning and management oversight.

PRINCIPAL OFFICERS OF THE CORPORATION

The following table lists the executive officers of the Corporation as of March

1, 2012:Name | | Age | | Position and/or Offices

With the Corporation | | Bank

Employee

Since | | Number of

Shares of the

Corporation | | Year First

Elected an

Officer |

Richard A. Grafmyre | | 58 | | President & Chief Executive Officer | | 2010 | | 1,078 | | 2010 |

Brian L. Knepp | | 37 | | Chief Financial Officer | | 2005 | | 619 | | 2005 |

Ann M. Riles | | 57 | | Senior Vice President and Chief Credit Officer | | 1983 | | 5,045 | | 2007 |

3, 2014:

|

| | | | | | | | | | | |

| Name | | Age | | Position and/or Offices With the Corporation | | Bank Employee Since | | Number of Shares of the Corporation | | Year First Elected an Officer |

| Richard A. Grafmyre | | 60 | | President & Chief Executive Officer of the Corporation and JSSB | | 2010 | | 1,130 |

| | 2010 |

| Brian L. Knepp | | 39 | | Senior Vice President and Chief Financial Officer of the Corporation and JSSB | | 2005 | | 1,012 |

| | 2005 |

| Robert J. Glunk | | 49 | | Senior Vice President and Chief Operating Officer of the Corporation; President and Chief Executive Officer of Luzerne | | 1985 | | 5,917 |

| | 1987 |

Biographical information for Mr. Grafmyre is set forth above under the caption “Information as to Nominees and Directors.”

Mr. Knepp joined the BankJSSB in 2005 as Vice President — Finance and became the Chief Financial Officer of the Corporation and JSSB

in April

2008.Ms. Riles2008 and Senior Vice President in 2012.

Mr. Glunk joined the Bank in

19831985 as a

loan officer,teller, was appointed Assistant Vice President in 1992, Vice President - Branch Administration in 2000, and was appointed Senior Vice President and Chief

CreditOperating Officer

of the Corporation and JSSB in

2007.2012. Mr. Glunk was appointed President and Chief Executive Officer of Luzerne in 2013.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of March

1, 2012,3, 2014, there were no persons who owned of record or who are known by the

Boardboard of

Directorsdirectors to be beneficial owners of more than 5% of the Corporation’s common stock.

7

BENEFICIAL OWNERSHIP AND OTHER INFORMATION REGARDING DIRECTORS AND MANAGEMENT

The following table sets forth, as of March

1, 2012,3, 2014, information regarding the number of shares and percentage of the outstanding shares of common stock beneficially owned by each director, executive officer, and as a group. Unless otherwise indicated in a footnote, shares of our common stock have not been pledged as security.

Name | | Principal Occupation for Past Five Years | | Year First

Became a

Director | | Amount & Nature of

Beneficial Ownership | | % of Total

Shares

Outstanding | |

Michael J. Casale, Jr. | | Principal, Michael J. Casale, Jr., Esq., LLC | | 1999 | | 21,584 | (1) | 0.56 | % |

H. Thomas Davis, Jr. | | Chairman & Chief Executive Officer of Davis Insurance Agency, Inc. | | 1999 | | 18,445 | (2) | 0.48 | % |

James M. Furey, II | | President & Owner of Eastern Wood Products | | 1990 | | 14,607 | (3) | 0.38 | % |

Richard A. Grafmyre | | President & Chief Executive Officer of the Corporation and Bank | | 2010 | | 1,078 | (4) | 0.03 | % |

D. Michael Hawbaker | | Executive Vice President of Glenn O. Hawbaker, Inc. | | 2007 | | 800 | (5) | 0.02 | % |

Leroy H. Keiler, III | | Leroy H. Keiler, III, Attorney at Law | | 2006 | | 549 | (6) | 0.01 | % |

Brian L. Knepp | | Chief Financial Officer of the Corporation and Bank | | N/A | | 619 | (7) | 0.02 | % |

R. Edward Nestlerode, Jr. | | Vice President and Chief Executive Officer of Nestlerode Contracting Co., Inc. | | 1995 | | 16,200 | (8) | 0.42 | % |

Ann M. Riles | | Senior Vice President & Chief Credit Officer of the Corporation and Bank | | N/A | | 5,045 | (9) | 0.13 | % |

William H. Rockey | | Retired; Former Senior Vice President of the Corporation and Bank; Former President of First National Bank of Spring Mills | | 1999 | | 32,912 | (10) | 0.86 | % |

Hubert A. Valencik | | Retired; Former Senior Vice President & Chief Operations Officer of the Bank; Former Senior Vice President of the Corporation | | 2005 | | 15,078 | (11) | 0.39 | % |

Ronald A. Walko | | Chairman of the Board; Former President & Chief Executive Officer of the Corporation and Bank | | 2000 | | 22,516 | (12) | 0.59 | % |

All Executive Officers and Directors as a Group | | 149,433 | | 3.89 | % |

|

| | | | | | | | | | | | | | |

| Name | | Principal Occupation for Past Five Years | | Year First Became a Director | | Amount & Nature of Beneficial Ownership | | | | % of Total Shares Outstanding |

| Daniel K. Brewer | | Principal & Owner, Brewer & Company, LLC | | 2012 |

| | 2,100 |

| | (1 | ) | | 0.04 | % |

| Michael J. Casale, Jr. | | Principal, Michael J. Casale, Jr., Esq., LLC | | 1999 |

| | 22,084 |

| | (2 | ) | | 0.46 | % |

| William J. Edwards | | President & Owner of JEB Environmental Technologies, Inc. | | 2012 |

| | 3,921 |

| | (3 | ) | | 0.08 | % |

| James M. Furey, II | | President & Owner of Eastern Wood Products | | 1990 |

| | 14,607 |

| | (4 | ) | | 0.30 | % |

| Robert J. Glunk | | Senior Vice President & Chief Operating Officer of the Corporation and President and Chief Executive Officer of Luzerne | | N/A |

| | 5,917 |

| | (5 | ) | | 0.12 | % |

| Richard A. Grafmyre | | President & Chief Executive Officer of the Corporation and JSSB | | 2010 |

| | 1,130 |

| | (6 | ) | | 0.02 | % |

| D. Michael Hawbaker | | Executive Vice President of Glenn O. Hawbaker, Inc. | | 2007 |

| | 2,200 |

| | (7 | ) | | 0.05 | % |

| Leroy H. Keiler, III | | Leroy H. Keiler, III, Attorney at Law | | 2006 |

| | 603 |

| | (8 | ) | | 0.01 | % |

| Joseph E. Kluger | | Chairman of the Board of Luzerne, Managing Partner of Hourigan, Kluger & Quinn P.C. | | 2013 |

| | 1,178 |

| | (9 | ) | | 0.02 | % |

| Brian L. Knepp | | Senior Vice President, Secretary, & Chief Financial Officer of the Corporation and JSSB | | N/A |

| | 1,012 |

| | (10 | ) | | 0.02 | % |

| John G. Nackley | | President and CEO of InterMetro Industries Corporation | | 2013 |

| | 1,432 |

| | (11 | ) | | 0.03 | % |

| R. Edward Nestlerode, Jr. | | Chairman of the Board of the Corporation, Vice President and Chief Executive Officer of Nestlerode Contracting Co., Inc. | | 1995 |

| | 17,728 |

| | (12 | ) | | 0.37 | % |

| William H. Rockey | | Retired; Former Senior Vice President of the Corporation and JSSB; Former President of First National Bank of Spring Mills | | 1999 |

| | 33,035 |

| | (13 | ) | | 0.69 | % |

| Jill F. Schwartz | | Senior Partner of Wyoming Weavers; Vice President of Fortune Fabrics, Inc.; Owner of Gosh Yarn It! | | 2013 |

| | 20,565 |

| | (14 | ) | | 0.43 | % |

| Hubert A. Valencik | | Chairman of the Board of JSSB, Retired; Former Senior Vice President & Chief Operations Officer of JSSB; Former Senior Vice President of the Corporation | | 2005 |

| | 15,078 |

| | (15 | ) | | 0.31 | % |

| Ronald A. Walko | | Retired; Former President & Chief Executive Officer of the Corporation and JSSB | | 2000 |

| | 22,732 |

| | (16 | ) | | 0.47 | % |

| All Executive Officers and Directors as a Group | | 165,322 |

| | | | 3.43 | % |

(1)Includes 15,918 shares held jointly with his spouse, 660 shares held by his spouse, and 5,006 shares held by his children.

(2)Shares held individually.

(3)Includes 6,547 shares held jointly with his spouse, 6,430 held individually, and 1,630 shares held by his spouse.

(4)Shares held individually.

(5)Includes 600 shares held jointly with his spouse and 200 shares held individually.

(6)Shares held jointly with his spouse.

(7)Shares held individually.

(8)Includes 7,631 shares held jointly with his spouse and his father, 6,858 shares held individually, 501 shares held by his children, and 1,210 shares held by Nestlerode Contracting Co., Inc.

(9)Includes 3,542 shares held jointly with her spouse and 1,503 shares held individually.

(10)Includes 31,670 shares held jointly with his spouse, and 1,242 shares held individually.

(11)Includes 3,310 shares held jointly with his spouse, and 11,768 shares held individually.

(12)Includes 19,896 shares held jointly with his spouse and children, 2,083 shares held individually, 435 shares held by his spouse, and 102 shares held jointly by his spouse and children.

| |

| (1) | Shares held individually. |

| |

| (2) | Includes 15,418 shares held jointly with his spouse, 1,660 shares held by his spouse, and 5,006 shares held by his children. |

| |

| (3) | Includes 804 shares held individually, 2,417 share held jointly with his spouse, and 700 shares held by his spouse. |

| |

| (4) | Shares held individually. |

| |

| (5) | Includes 6,547 shares held jointly with his spouse, 6,430 held individually, and 1,630 shares held by his spouse. |

| |

| (6) | Shares held individually. |

| |

| (7) | Shares held jointly with his spouse. |

| |

| (8) | Shares held jointly with his spouse. |

| |

| (9) | Shares held jointly with his spouse. |

| |

| (10) | Shares held individually. |

| |

| (11) | Shares held individually. |

| |

| (12) | Includes 8,309 shares held jointly with his spouse and his father, 7,534 shares held individually, 551 shares held by his children, and 1,334 shares held by Nestlerode Contracting Co., Inc. |

| |

| (13) | Includes 31,670 shares held jointly with his spouse, and 1,365 shares held individually. |

| |

| (14) | Shares held individually. |

| |

| (15) | Includes 3,310 shares held jointly with his spouse, and 11,768 shares held individually. |

| |

| (16) | Includes 19,939 shares held jointly with his spouse and children, 2,245 shares held individually, 435 shares held by his spouse, and 113 shares held jointly by his spouse and children. |

SECTION 16 (a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires our officers and directors, and any persons owning ten percent or more of our common stock, to file in their personal capacities initial statements of beneficial ownership on Form 3, statements of changes in beneficial ownership on Form 4, and annual statements of beneficial ownership on Form 5 with the Securities and Exchange Commission (the “SEC”). Persons filing such beneficial ownership statements are required by SEC regulation to furnish us with copies of all such statements filed with the SEC. The rules of the SEC regarding the filing of such statements require that “late filings” be disclosed in the Corporation’s proxy statement. Based solely on the reports received by us or filed with the SEC and on written representations from reporting persons, we believe all such persons complied with all applicable filing requirements during

2011, with the exception of Mr. Plummer, for whom one late Form 4 was filed reporting a single transaction.

2013.

COMPENSATION DISCUSSION AND ANALYSIS

The Compensation Discussion and Analysis addresses the following issues: members of the Compensation and Benefits Committee (the “Committee”) and their role, compensation-setting process, philosophy regarding executive compensation, and components of executive compensation.

8

Committee Members and Independence

The Committee is comprised of

four (4)three (3) independent directors under the requirements set forth in the NASDAQ listing standards. The members of the Committee are: Michael J. Casale, Jr.,

H. Thomas Davis, Jr., D. Michael Hawbaker, and R. Edward Nestlerode, Jr.

The Committee’s focus is to establish a compensation policy and philosophy that will enable the Corporation to attract, retain, motivate, and reward executive officers that are critical to the success of the Corporation. In doing so, the Committee:

·

reviews and adjusts the principles guiding the compensation policy to maintain alignment with short and long-term strategic goals and to build shareholder value;

·

establishes performance objectives including, but not limited to, earnings, return on assets, return on equity, total assets, and quality of the loan portfolio;

·

evaluates the performance of the executive officers in comparison to the performance goals;

·

determines the compensation of executive officers and the components of the compensation;

·

administers the retirement plans of the Corporation, including the defined benefit, defined contribution, and 401(k) plans;

·

administers the 2006 Employee Stock Purchase Plan;

·

recommends changes to compensation plans, cash or equity, to the full Board of Directors;

·

reviews and recommends changes to succession plans; and

·

reviews and recommends changes to director compensation.

The Committee meets as often as necessary. During

2011,2013, the Committee held one meeting at which it determined and approved

certain wage and benefit changes for the

20122014 fiscal year. The Committee

does not maintainmaintains a written charter. The Committee works with the President and Chief Executive Officer to determine the meeting agenda and material to be reviewed. The materials and inputs utilized may include, but are not limited to, the following:

·

financial reports outlining budget to actual performance;

·

reports of corporate achievement/recognition by outside parties;

·

forecasted financial results as compared to the current budget and actual results;

·

peer financial analysis and comparison;

·

completion and progress of meeting strategic goals;

·

peer equity and cash compensation data;

·

national and regional compensation surveys; and

·

financial impact of current and proposed compensation programs.

The Committee

setsset the compensation of the executive officers and other employees during the fourth quarter of

each fiscal year2012 for 2013 and during the first quarter of 2013 for the

nextperiod covering the remainder of 2013 and first part of 2014. The committee set the 2014 compensation for the Chief Executive Officer and Chief Financial Officer during the fourth quarter of 2013 for the 2014 fiscal year. Although the decisions are made

at a point in

the fourth quarter,time, the Committee continuously monitors the performance of the Corporation and executives throughout the year as part of the routine full

Boardboard of

Directorsdirectors meetings.

The Committee utilizes the input and assistance of management when making compensation decisions. Management input includes:

·

employee performance evaluations and compensation recommendations;

·

reporting actual and forecasting future results;

·

establishing performance objectives;

·

review and recommendations of non-cash employee compensation programs; and

·

assistance with Committee meeting agendas.

The President and Chief Executive Officer has direct involvement with the Committee during the meetings in order to provide status updates on the attainment of strategic goals, discuss performance evaluations, and make recommendations on executive officer compensation packages, for the named executive officers other than himself.

Annually, the Committee meets to evaluate the performance of the executive officers, set the compensation for the

following fiscal year, and to determine their cash bonus to be

paid for the current year.9

paid.

The Committee believes that the base salary of the named executive officers is the cornerstone of the compensation package and is the primary source of compensation to the executive. The base salary provides a consistent level of pay to the executive, which the Committee feels decreases the amount of executive turnover, promotes the long-term goals of the Corporation, and is a tax deductible expense. The factors used in determining the level of base salary include the executive’s qualifications and experience, tenure with the Corporation, responsibilities, attainment of goals and objectives, past performance, and peer practices. A review of past performance and the attainment of goals and objectives are reviewed annually as part of the formal annual performance review. During the review, which

occursoccurred during the fourth quarter

of 2013 and covered the 2013 fiscal year, objectives and goals for the

next year and upcoming milestones related to the corporate strategic plan

arewere discussed. Peers for the Corporation are bank holding companies

headquartered within

the Philadelphia Federal Reserve DistrictPennsylvania, Maryland, New Jersey, New York, Ohio, and West Virginia with assets between

$500 million$1 billion and

$1$2 billion and include the following:

AmeriServ

|

| | | | |

| ACNB Corporation | | BCB Bancorp, Inc. | | Bridge Bancorp, Inc. |

| Canandaigua National Corp. | | Cape Bancorp, Inc. | | Center Bancorp, Inc. |

Chemung Financial Inc.Corp. | | CCFNBCitizens and Northern Corp.

| | CNB Financial Corp. |

| Codorus Valley Bancorp | | Connectone Bancorp, Inc. | | ESB Financial Corp. |

| ESSA Bancorp, Inc. | | First Citizens Banc Corp | | First Mariner Bancorp |

| First United Corp. | | Franklin Financial Services Co. | | Intervest Bancshares Corp. |

| LNB Bancorp, Inc. | | Orrstown Financial Services, Inc. | | Peapack-Gladstone Financial Co. |

Dimeco,Peoples Bancorp, Inc.

| | DNBPremier Financial Corporation

Bancorp, Inc. | | ENB Financial Corp.

Shore Bancshares, Inc. |

Fidelity D & DSuffolk Bancorp

| | Summit Financial Group, Inc. | | First Keystone Corporation

| | Franklin Financial Services Corp.

|

Harleysville SavingsUnited Community Financial Corp.

| | Honat Bancorp, Inc.

| | Integrity Bancshares, Inc.

|

Mid Penn Bancorp, Inc.

| | Penseco Financial Services Corp.

| | QNB Corporation

|

Data for these peers is gathered from various sources including, but not limited to, SEC filings, Federal Reserve filings, and other information publicly released by the peer companies. The Committee utilizes such comparative information as one component solely for determining base salary for such executives. Other components considered by the Committee include the factors described above. The Committee does not assign relative weights to any one component but considers the entire mix of information. The Committee does not consider such comparative information in connection with other elements of the overall compensation of such executives.

The Committee administers a Performance-Based Cash Incentive Plan originally adopted in March

2010.2010 in which certain executive officers of the Corporation, including the named executive officers, participate. The plan provides at-risk compensation awards to eligible employees, which include full-time employees of

the BankJSSB (except employees

who are eligible for employeewhose compensation is commission

incentive programs)based) and part-time employees who are eligible to participate in the

Bank’sJSSB's Pension Plan and/or 401(k) Plan. In addition, the employee must receive an overall rating of “Good” or higher on his or her most recent individual performance appraisal

prior tofor the

end offiscal year covered by the

plan year.performance appraisal. The plan is designed to support organizational objectives and financial goals set forth in the

Bank’sJSSB’s strategic business plan and financial plan. The plan further aligns the interests of the Corporation’s shareholders with

those of the Bank’s employees and assists

the BankJSSB in attracting, retaining, and motivating high-quality personnel, who contribute to the success and profitability of

the Bank.JSSB.

The Committee by resolution establishes six target results criteria on an annual basis. Target results are the annual goals of

the Bank,JSSB, which are consistent with

the Bank’sJSSB’s strategic business plan and financial plan, which must be met in order to receive a cash award under the plan. The target results integrate industry peer group standards with the goals set forth in

the Bank’sJSSB’s strategic business plan and financial plan. Targets are weighted to reflect the relative importance of each goal to

the Bank’sJSSB’s goals under its strategic business plan and financial plan. Target measures that may be used by the Committee include, but are not limited to, return on equity, gross loan growth, growth in deposits (excluding brokered deposits), growth in core deposits, net interest margin, and net overhead as a percent of average assets. Target results are set at levels intended to be challenging, but more likely than not to be achieved, or come substantially close to being achieved.

The Committee has the discretion to exclude nonrecurring or extraordinary items of income, gain, expense, or loss, or any other factor it may deem relevant in its determination as to whether the target results have been satisfied. The Committee must conclude that an award, in such a circumstance, would ensure that the best interests of

the BankJSSB and the Corporation’s shareholders are protected and are not in conflict with the interests of the plan’s participants.

Cash awards are based upon a percentage of eligible compensation, which will be the employee’s Form W-2 gross wages net of any amount included as a payment for any prior year bonus awards. The higher the eligible employee’s position,

is with the Bank, the greater the percentage of the employee’s eligible compensation may be received as a cash award. This reflects the

Bank’sJSSB’s belief that the performance of our named executive officers and other members of upper management has relatively greater impact on the performance of

the Bank.JSSB.

If the plan participants’ employment is terminated with

the Bank,JSSB, other than retirement (which generally will be attaining the age of 65) or death during the plan year, the participant will not be eligible to receive a bonus award even if the target results are reached. If plan participant is terminated as a result of death or retirement and the participant worked at least six months during the plan year, the

10

participant, or in the case of death, the participant’s beneficiary, will be eligible to receive a pro-rated bonus at the same time and manner as cash bonuses are paid to the other participants in the plan.

The plan is administered by the Committee, but annual awards determined by the Committee under the plan are subject to the approval of the Boardboard of Directorsdirectors of the Bank.JSSB. The Committee may only make awards when it deems such awards are in the best interests of the Bank,JSSB, the Corporation’s shareholders, and the plan participants. The Committee or the Boardboard may take action to amend,

modify, suspend, reinstate, or terminate the

Planplan at any time. Such amendments, modifications, suspensions, reinstatements, or terminations may apply retroactively.

For

2011,2013, the Committee established six weighted performance targets to be satisfied as a condition to the payment of any bonuses under the plan for

2011.2013. The performance factors and weightings for each factor for

2011,2013, all of which exclude securities gains or losses where applicable, were as follows: Return on Equity (target:

16.18%14.68%; weighting: 30%); Gross Loan Growth (target:

$19.894$22.595 million; weighting: 20%); Deposit Growth, excluding brokered deposits (target:

$46.377$32.565 million; weighting: 5%); Core Deposit Growth (target:

$15.628$23.677 million; weighting: 15%); Net Interest Margin (target:

4.48%4.38%; weighting: 15%); and Net Overhead as a Percentage of Average Assets (target:

1.86%1.67%; weighting: 15%). The Bank’s actual performance measured against the weighted target performance factors resulted in performance of

approximately 170%145% of targeted goals and resulted in potential cash awards for Tier 1 participants

(the President and CEO) of up to